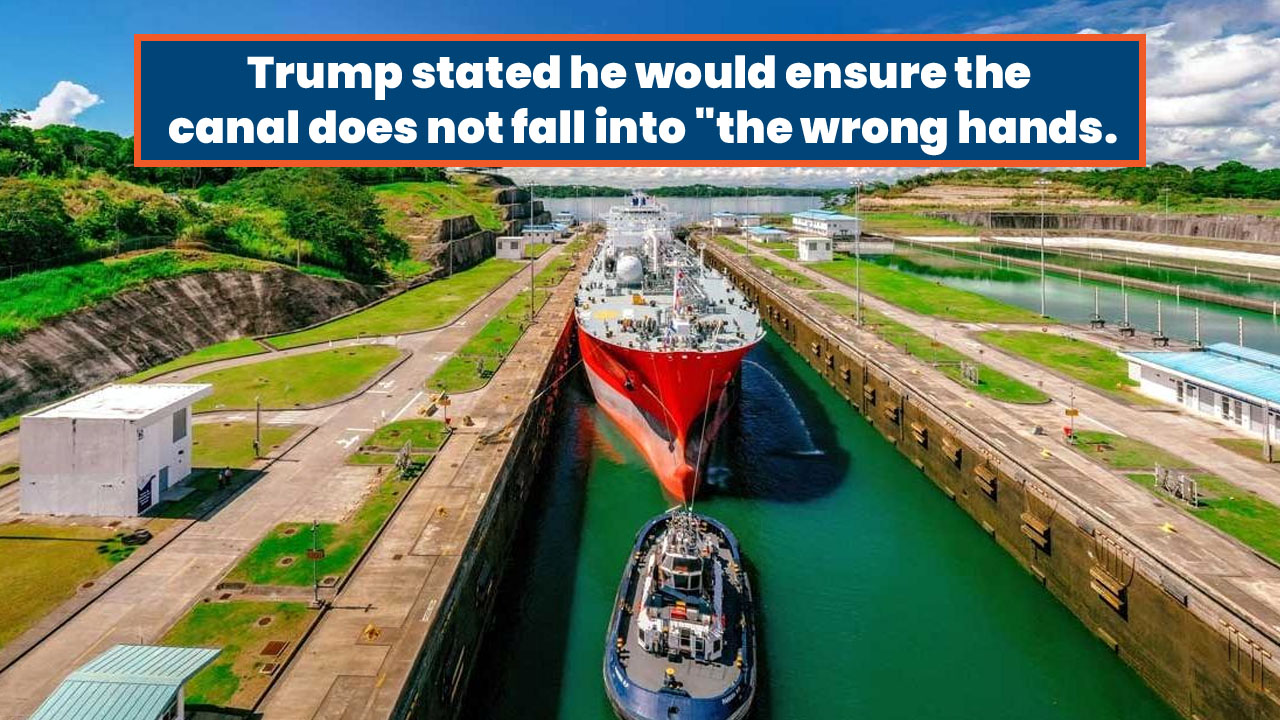

In Asia, spot cash differentials have shifted to a premium for the first time in a month, driven by robust January buying interest and a scarcity of lower-priced sellers in the open market. The steeper backwardation in the swaps market contributed to these gains, although a buy-sell gap has constrained in-depth discussions. Notably, trading activity has primarily centered around the regrade spread differential, with physical markets witnessing a lack of deals for the third consecutive session. Despite this positive development, refining margins, particularly for gasoline and jet fuel, faced challenges. Gasoline refining margins slipped to around $22 a barrel, influenced by overnight price weakness in the West and limited swaps market activity. Jet fuel refining margins also experienced a decline, reaching slightly below $23 a barrel. Although the regrade spread for jet fuel strengthened to around 73 cents a barrel, ready sellers in the market tempered overall gains. Additionally, the report highlights the trajectory of U.S. crude oil inventories and rising fuel stockpiles, along with the continued journey of the oil tanker Cururo, taking an extended route from Houston to Chile due to the Panama Canal drought. Overall, the oil market remains influenced by concerns about oversupply and demand.

SOURCE:GOOGLE

All Categories

All Categories