The Drewry LNG Shipping Equity Index faces a 7.5% YTD decline amidst softer LNG shipping spot rates, impacting Nakilat, Flex LNG, and Golar LNG. Meanwhile, Capital Product Partners' acquisition of 11 LNG vessels reflects a bullish outlook on LNG shipping, emphasizing long-term attractiveness.

On the LPG front, stocks like Stealth Gas, BW LPG, and Navigator Holdings see significant YTD increases, driven by high freight rates and strong financial results. BW LPG's plans for a dual listing in the US and Navigator Holdings' ethylene export terminal expansion contribute to positive market sentiment.

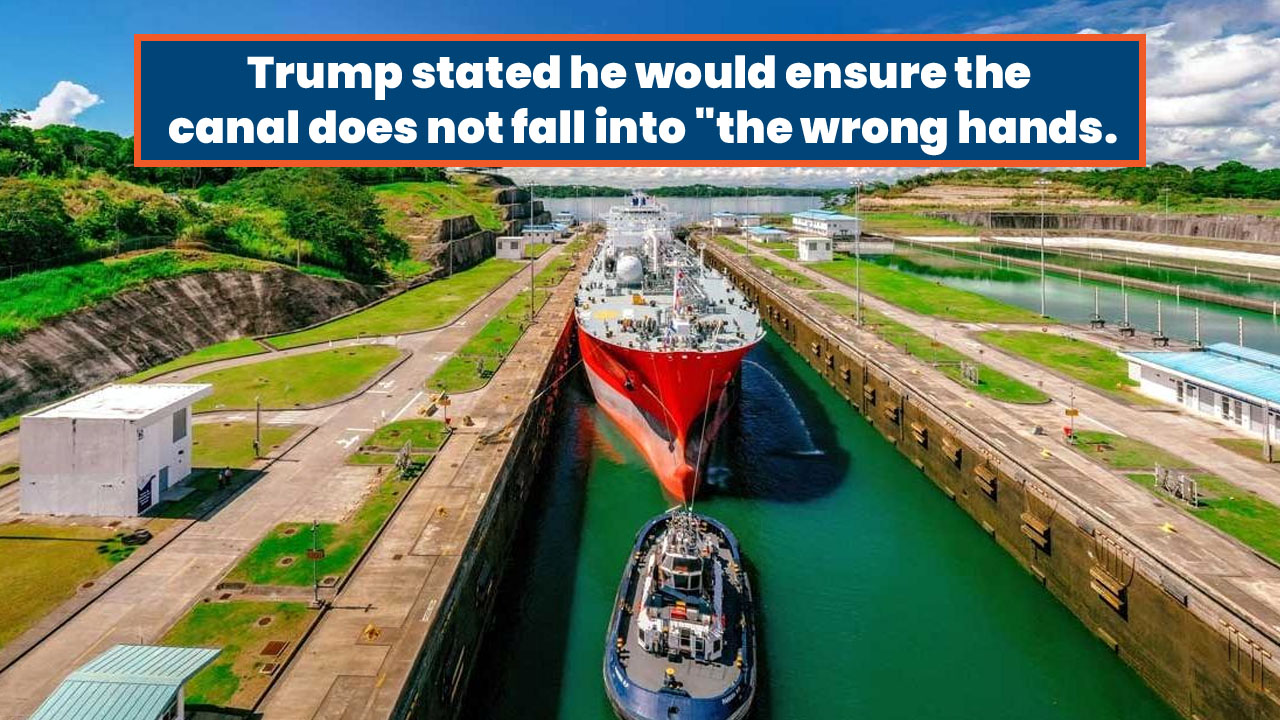

The robust performance of LPG shipping rates in 2023 is attributed to factors like growing US LPG exports to Asia, Panama Canal waiting times, and geopolitical tensions.

SOURCE: GOOGLE

All Categories

All Categories